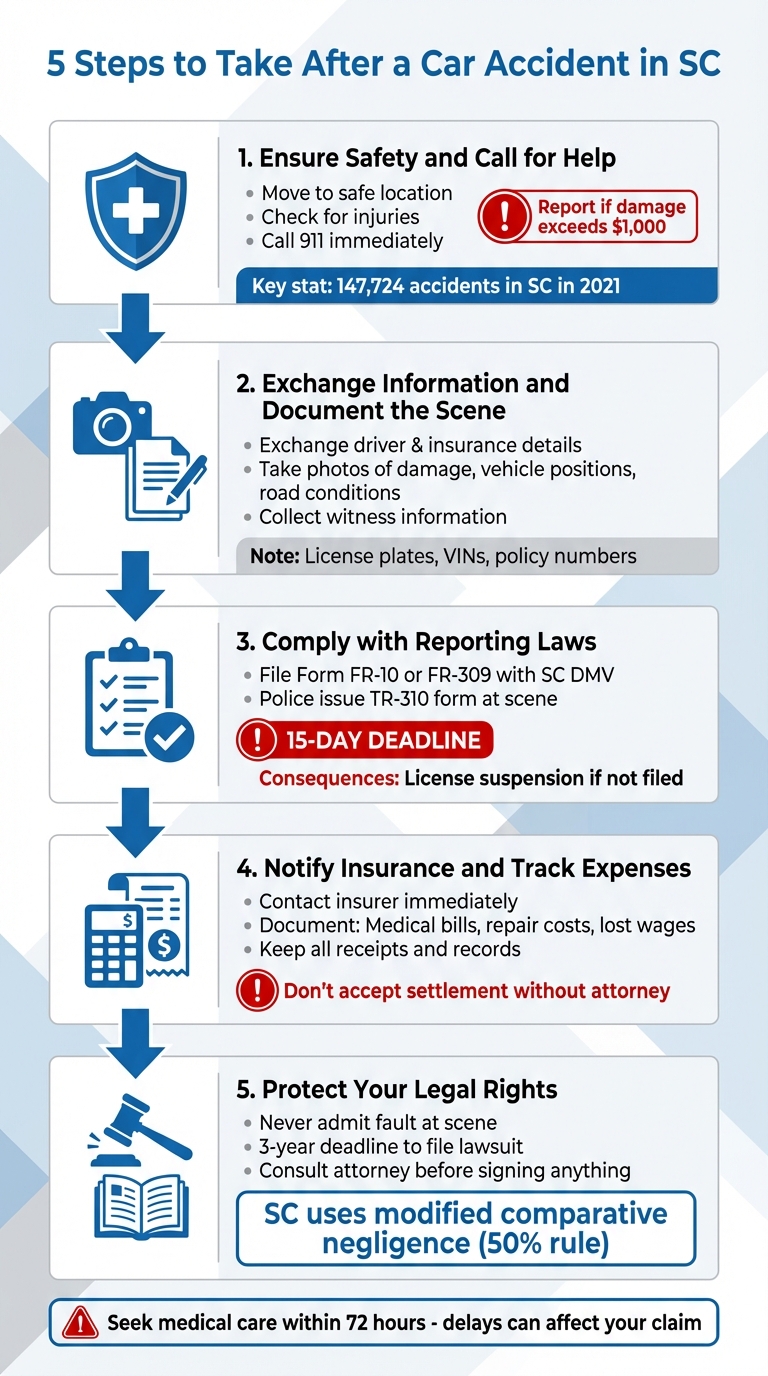

When you’re involved in a car accident in South Carolina, your actions afterward can directly impact your safety, legal standing, and compensation. Here’s a quick rundown of what to do:

- Ensure Safety and Call for Help: Move to a safe spot if possible, check for injuries, and call 911. South Carolina law requires reporting accidents involving injuries, fatalities, or property damage over $1,000.

- Exchange Information and Document the Scene: Share contact and insurance details with the other driver. Take photos, note vehicle positions, and gather witness information.

- Comply with Reporting Laws: File required forms like FR-10 or FR-309 with the South Carolina DMV within 15 days to avoid penalties.

- Notify Your Insurance and Track Expenses: Inform your insurer promptly and keep detailed records of medical bills, repair costs, and lost wages.

- Protect Your Legal Rights: Avoid admitting fault or signing settlement offers without consulting an attorney. South Carolina’s modified comparative negligence rule affects how compensation is calculated.

These steps ensure compliance with state laws and protect your ability to seek fair compensation. Always document everything thoroughly and seek legal advice if needed.

5 Essential Steps After a Car Accident in South Carolina

Step 1: Ensure Safety and Call for Help

Move to a Safe Location

If you’re in an accident, South Carolina law requires you to stop at the scene. However, if your vehicle is drivable and blocking traffic, carefully move it to the shoulder or a nearby safe area. Turn on your hazard lights and, if possible, set up flares or reflective triangles to alert other drivers. Once you’ve moved your vehicle, make sure to stay off the roadway to avoid further danger.

Check for Injuries and Call 911

Take a moment to assess everyone involved for injuries. Keep in mind that shock or adrenaline might mask pain, so even if you feel okay, there could be internal injuries like bleeding or head trauma. If anyone is hurt, no matter how minor it seems, call 911 immediately. South Carolina law requires you to notify law enforcement or the South Carolina Highway Patrol if the accident involves injuries or fatalities.

When you call 911, provide as much detail as possible about your location, such as mile markers, exits, or nearby intersections. Clearly describe any injuries and mention any immediate dangers, such as leaking fuel, fires, or vehicles obstructing traffic. Accurate information helps first responders prepare appropriately.

South Carolina Reporting Requirements

Even if no one appears injured, you must contact law enforcement if property damage seems to exceed $1,000. In 2021 alone, South Carolina reported 147,724 accidents, with 53,596 resulting in injuries. Having an official accident report from law enforcement is crucial – it serves as an impartial record and can protect you during the insurance claims process.

If the police respond, they will issue a green FR-10 form. This form needs to be completed by your insurance company and sent to the South Carolina Department of Motor Vehicles (SCDMV) within 15 days to confirm your coverage at the time of the accident. Failing to submit this form can lead to license suspension or even hit-and-run charges.

Step 2: Exchange Information and Document the Scene

Exchange Driver and Insurance Information

Once everyone’s safe, the next step is to share and collect key details. Exchange your name, address, vehicle registration, driver’s license information, and insurance details with the other driver. To avoid errors, take clear photos of these documents. If there are witnesses, get their contact information too. Be mindful not to apologize or admit fault – it could be misinterpreted later.

For the vehicles involved, jot down the license plate number, make, model, year, color, and the Vehicle Identification Number (VIN), which is usually located on the driver’s side dashboard or inside the door jamb. Also, note the insurance provider, policy number, and the policyholder’s name. Don’t depend entirely on the police to gather witness details – they might overlook someone who could support your account of the incident.

Document the Accident Scene

Take detailed photos of the damage to all vehicles, their positions, and any relevant road signs or obstacles. Capture multiple angles to ensure nothing is missed. Use GPS, mile markers, or nearby landmarks to pinpoint the exact location. A video of the entire scene can also help illustrate the layout and traffic flow.

If you notice anything unusual about the other driver – like slurred speech, the smell of alcohol, or distracted behavior – write it down. These observations could be important later. Just make sure to prioritize your safety while documenting.

Why Documentation Matters

In South Carolina’s at-fault system, having thorough documentation – like photos and witness statements – can be crucial in proving negligence. Independent evidence can fill gaps in police reports. As Hughey Law Firm points out:

"Car accidents are often he said/she said affairs. Drivers don’t like to admit that they caused an accident. Without witness testimony or video evidence, all the insurance company has to go off of is the testimony from both drivers and physical evidence."

Road conditions, skid marks, and vehicle positions can change quickly once the scene is cleared, so documenting everything immediately is essential. Your independent records can make a big difference in helping your legal team challenge inaccuracies and provide clarity to juries or insurance adjusters. With solid evidence, you’ll be better prepared to meet South Carolina’s reporting requirements and protect your case.

Step 3: Comply with South Carolina Accident Reporting Laws

Once you’ve ensured everyone’s safety and documented the incident, the next step is to follow South Carolina’s accident reporting laws.

When to Report an Accident

In South Carolina, you’re required to act promptly after an accident. If anyone is injured or killed, you must call 911 immediately. If the police don’t investigate the crash and it involves injury, death, or property damage of $1,000 or more, you are legally obligated to file a written report with the South Carolina Department of Motor Vehicles (SCDMV).

Reporting Procedures and Forms

When a police officer investigates the accident, they will complete the official South Carolina Traffic Collision Report (Form TR-310). The officer will also give you Form FR-10, which is an insurance verification document. You need to sign this form and have your insurance company fill out its section. Afterward, send the completed form to the SCDMV Financial Responsibility office in Blythewood, SC, within 15 days. Keep a copy for your records.

If the police are not involved and the damage exceeds $1,000 or an injury is reported later, you must file Form FR-309 (Driver’s/Traffic Collision Report). This form can be downloaded from the SCDMV website. Just like with Form FR-10, your insurance company must complete part of it to confirm your liability coverage. You must also submit this form within 15 days.

Consequences of Failing to Report

Failing to report an accident on time can lead to serious consequences. The SCDMV may treat a missed report as proof that your vehicle was uninsured at the time of the crash. This could result in the suspension of your driver’s license and vehicle registration. If you were uninsured, you might also need to file an SR-22, which serves as proof of future financial responsibility. Additionally, without an official report, your insurance company may refuse to process claims, leaving you to cover repair costs and medical bills on your own.

sbb-itb-ce0cbb0

Step 4: Notify Your Insurance and Track Expenses

Once you’ve documented the accident and filed the necessary legal reports, it’s time to notify your insurance company and keep a detailed record of all expenses. These steps are key to ensuring your claim is processed smoothly and accurately.

Contact Your Insurance Company

Most insurance policies require you to report any accident, no matter who was at fault. When notifying your insurer, provide specific details such as the date, time, and exact location of the accident. Include the other driver’s name, contact information, driver’s license number, license plate number, and insurance policy details. If law enforcement responded to the scene, make sure to share the police report number or a copy of the TR-310 form. Additionally, submit any FR-10 form you received to your insurer as required by law.

Before speaking with the at-fault driver’s insurance company, it’s a good idea to consult an attorney. As the Law Office of Kenneth Berger explains:

"The insurance company and adjuster’s main goal is to settle your claim for as little as possible."

Insurance adjusters might offer a low settlement or use your statements to minimize your payout. To protect yourself, avoid admitting fault or apologizing during any conversations with adjusters. Once you’ve notified your insurer, focus on keeping track of all accident-related expenses.

Track Medical, Vehicle, and Other Expenses

Start organizing your records right away by setting up a dedicated folder – either physical or digital – to store every document related to the accident. For medical expenses, save receipts for treatments, tests, prescriptions, over-the-counter medications, and co-pays. If you purchase medical supplies like bandages or braces, keep those receipts too.

For vehicle-related costs, gather repair estimates from multiple shops, towing receipts, and invoices for rental cars. If you’ve missed work due to medical appointments or recovery, document your lost wages by keeping a record of the shifts missed. Ask your employer for a written statement confirming your inability to work and hold onto copies of your pay stubs.

If you’ve had to travel for medical appointments, log your mileage and save receipts for gas or parking fees. As Christian & Christian Law notes:

"The more organized and detailed your records are, the better chance you will have at achieving a positive outcome."

Document All Accident-Related Losses

Thorough documentation not only strengthens your insurance claim but also links your injuries directly to the accident, making it harder for insurers to argue otherwise. Consider keeping a daily pain journal to record how your injuries affect your physical and emotional well-being. Note disruptions to your daily life, such as trouble sleeping, working, or caring for family members. While this journal may not always be admissible as legal evidence, it can help support claims for non-economic damages like pain and suffering.

Request itemized statements from healthcare providers and keep a record of all communications with insurance companies or medical providers. If your health insurance initially covered any costs, retain those records too. They may be needed to address potential liens your provider could place on your settlement. Finally, avoid signing any insurance release forms or accepting settlement offers without consulting a lawyer. As McKinney, Tucker & Lemel, LLC advises:

"Initial offers often do not fully account for all your future medical needs or lost wages."

Step 5: Protect Your Legal Rights in South Carolina

Understand South Carolina’s Fault-Based System

In South Carolina, the driver responsible for an accident is held liable for any injuries and property damage caused. The state follows a modified comparative negligence rule, which allows you to recover damages as long as your share of fault is 50% or less. However, your compensation will be reduced by the percentage of fault assigned to you. As David Goguen, J.D. explains:

"South Carolina is a ‘modified comparative negligence’ state. This means you can still recover compensation… as long as your fault wasn’t greater than the other party’s."

Here’s an example: If you’re found to be 10% at fault and awarded $100,000 in damages, your final compensation would be reduced to $90,000. But if you’re determined to be more than 50% at fault, you won’t be eligible to recover any damages. Keep in mind, you generally have a three-year deadline from the accident date to file a lawsuit for personal injury or property damage in South Carolina.

Avoid Common Post-Accident Mistakes

After an accident, your actions can significantly impact your ability to secure fair compensation. Certain mistakes can weaken your claim, so it’s critical to proceed carefully. For instance, never admit fault or apologize at the scene. As the Law Office of Kenneth Berger points out:

"Although you may think it’s proper manners to apologize in an accident situation, this is often misconstrued as admitting fault."

Another key tip: Stay off social media. Insurance adjusters often scour platforms like Facebook and Instagram to find posts that might undermine your injury claims. Additionally, avoid signing any insurance release forms or accepting settlement offers without consulting a lawyer. Signing prematurely could prevent you from seeking further compensation if new injuries or damages come to light later.

Seek Legal Assistance from Brendan M. Delaney Law Firm LLC

To safeguard your rights and counter insurance company strategies, it’s wise to consult an attorney early. The Brendan M. Delaney Law Firm LLC brings over 24 years of experience handling personal injury cases in South Carolina. They handle evidence collection, manage communication with insurers, and work to negotiate any liens to maximize your settlement. If negotiations fail, they’re ready to take your case to trial. Most importantly, they operate on a contingency fee basis, meaning you don’t pay unless they win your case. Plus, they offer a free initial consultation to review your situation and guide you through your legal options.

Conclusion

What you do after a car accident can have a huge impact on the outcome. By following these five key steps – ensuring everyone’s safety, documenting the scene, adhering to South Carolina’s reporting requirements, notifying your insurance company, and safeguarding your legal rights – you set yourself up to secure fair compensation and steer clear of costly missteps.

Keep in mind, South Carolina law requires that you report accidents involving injury, death, or property damage exceeding $1,000 within 15 days. Failing to do so could result in license suspension and other penalties. Additionally, it’s crucial to seek medical care within 72 hours, even if you feel fine. Insurance companies often scrutinize how quickly you get treatment when determining settlement offers. The choices you make after a collision play a pivotal role in proving liability and ensuring you’re compensated for medical bills, lost income, and property damage.

FAQs

What should I do if the other driver refuses to provide their insurance information after an accident?

If the other driver refuses to provide their insurance information, it’s important to stay composed and take these steps to safeguard yourself:

- Make a record of their refusal. Note down the time, location, and any details about the interaction. This can be helpful later if questions arise.

- Collect other identifying details. Write down their license plate number, the make and model of their vehicle, and, if possible, try to obtain their driver’s license number.

- Call the police right away. Filing an official accident report can be critical for both insurance claims and any potential legal matters.

- Follow up through official channels. You can request the driver’s insurance details by filing a South Carolina Traffic Collision Report (FR-309) with the South Carolina DMV.

- Inform your insurance company. Let your insurer know about the incident as soon as you can to ensure they’re aware of the situation.

By taking these steps, you’ll have the documentation and support you need to manage the situation effectively.

How can I show that I wasn’t at fault in a car accident in South Carolina?

If you’re involved in a car accident in South Carolina and need to prove you weren’t at fault, gathering solid evidence is key. Start by documenting everything right away. Snap clear photos and videos of the vehicles, the damage, skid marks, traffic signs, road conditions, and any other factors that might have played a role, like weather conditions. Talk to witnesses, get their contact information, and, if possible, record their statements about what they saw. Don’t forget to request a copy of the police report – it often includes the officer’s perspective on who was at fault.

Other types of evidence can also strengthen your case. Think dashcam footage, traffic camera recordings, or even black-box data that shows details like speed or braking patterns. Organize all of this information to build a timeline that highlights your responsible actions – like stopping at a red light or driving within the speed limit – and contrasts them with the other driver’s mistakes, such as running a stop sign or texting while driving. If you’re unsure how to present your evidence, a South Carolina car accident attorney can help ensure your case is handled properly and your rights are safeguarded.

What happens if I don’t report a car accident to the SCDMV within 15 days?

Failing to report a car accident to the South Carolina Department of Motor Vehicles (SCDMV) within the 15-day deadline can have serious consequences. If you miss this window, the SCDMV might assume your vehicle was uninsured at the time of the accident. This assumption could lead to legal penalties, including fines or even charges for driving without insurance.

To steer clear of these issues – like fines, license suspension, or other legal troubles – make sure to file your report on time. Double-check that all the information you provide is accurate and complete to avoid further complications.